tax sheltered annuity definition

A 403 b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. A tax-sheltered annuity is a type of investment vehicle that allows an employee to make pretax contributions from income to a retirement account.

The Hierarchy Of Tax Preferenced Savings Vehicles

A type of retirement plan under Section 403 b of the Internal Revenue Code that permits employees of public educational organizations or tax-exempt organizations.

. Ad Get The Most Income. Compare Quotes From 31 Top Companies. Ad Annuities are often complex retirement investment products.

Tax-sheltered annuity TSA A retirement plan that permits an employee of a tax-exempt charitable educational or religious institution to contribute a certain portion of wages or. A tax-sheltered annuity TSA is a retirement plan for non-profit organizations such as schools hospitals charities and churches. Tax-Sheltered Annuity is a retirement annuity plan for employees of tax-exempt organizations and public schools to make contributions from hisher income.

These organizations can set up a TSA. The employee is not taxed on the contribution until heshe begins to make. Also known as a tax-sheltered annuity a 403 b plan is an employer-sponsored plan designed for employees of certain tax-exempt organizations eg hospitals churches charities and public.

A retirement plan in which an employee makes tax-deferred contributions from hisher pre-tax income. A tax-deferred annuity TDA commonly referred to as a tax-sheltered annuity TSA plan or a 403 b retirement plan is a retirement savings plan available to employees of. This annuity plan is also known.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Both are essentially tax-sheltered shells that house investment funds. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Ad Compare Multiple Annuities Each With Their Own Tax Benefits. Tax sheltered annuities for employees of Section 501 C 3 organizations. A variable annuity is the most comparable to an IRA.

Its similar to a 401 k plan maintained by a for-profit entity. Tax-Sheltered Annuity TSA is a form of retirement savings plan in which the contributions made are from the income that has not been taxed and therefore the contributions and interest. However variable annuities have higher annual.

A tax-sheltered annuity TSA also referred to as a tax-deferred annuity TDA plan or a 403 b retirement plan is a retirement savings plan for employees of certain public. Since contributions are pretax. Learn some startling facts.

Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity. A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities.

The tax sheltered annuity is a deferred tax arrangement expressly granted by Congress in IRC Section 403 b. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity.

The Tax Sheltered Annuity Tsa 403 B Plan

The Tax Sheltered Annuity Tsa 403 B Plan

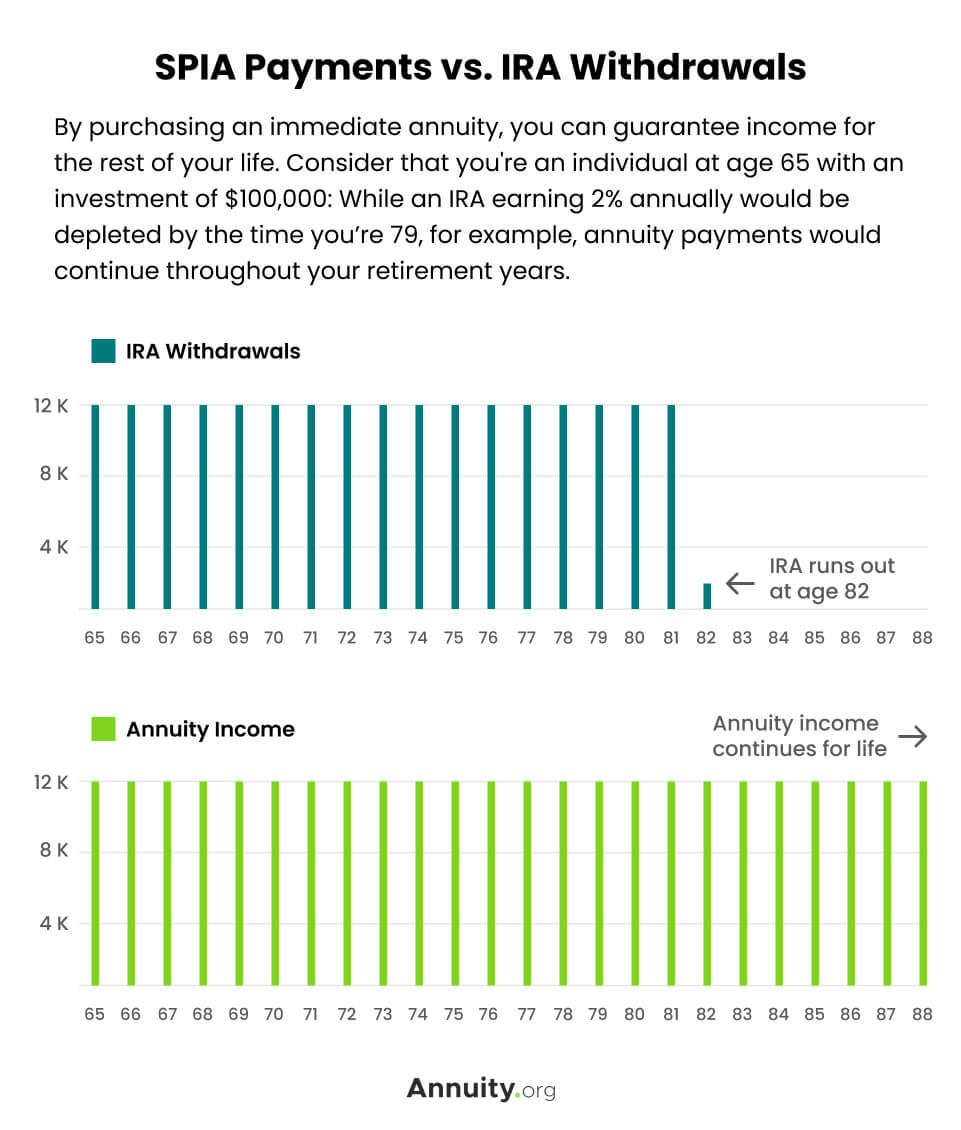

Single Premium Immediate Annuity Spia Rates Pros Cons

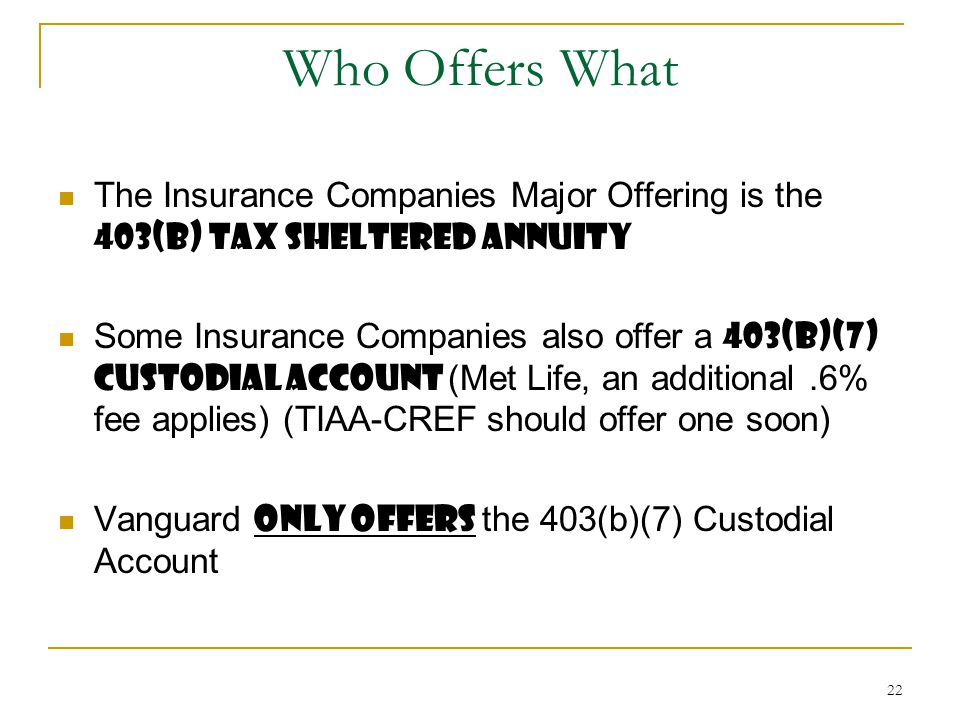

Part Time Faculty Retirement Workshop Ppt Download

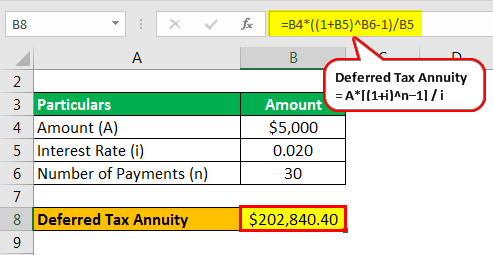

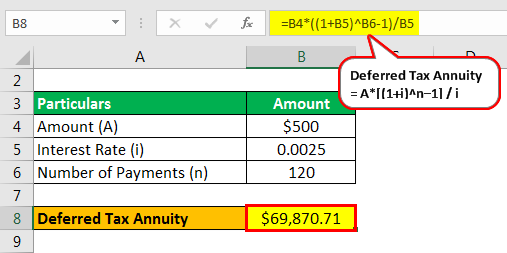

Tax Deferred Annuity Definition Formula Examples With Calculations

Taxsheltered Annuity Plans Also Known As 403b Plans

Introduction To Annuities Ppt Download

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download

Tax Deferred Annuity Definition Formula Examples With Calculations

What You Should Know About Tax Sheltered Annuities The Motley Fool

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Annuity Taxation How Various Annuities Are Taxed

Annuity Lifetime Income Later Safety Guarantees Magi

Tax Deferred Annuity Definition Formula Examples With Calculations

What Are Fixed Annuities Fixed Annuity Definition

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What Tax Deferred Annuities Are And How They Work

Tax Sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits